British American Tobacco: A Qualitative Analysis (July 2024)

Trying to measure the moat, capital allocation and overall business quality of BAT

Hello, fellow investors!

Today, we’re diving into British American Tobacco’s (BAT) 2023 Annual Report. Me, myself and AI, have sifted through BAT’s Annual Report and found some interesting insights to share.

You can download the research pack below:

The pack includes the following:

The Short Report (Only 3 slides on the Moat Score, 3 on Capital Allocation, and 3 on Business Quality) (Click Here)

The extracted text from the annual report (in CSV) (Click Here)

The Annual Report that I used for the analysis (Click Here)

Some fun stats:

Annual Report Pages: 412

Annual Report Words: 303,321

Extracted Words: 22,242

Reading Time Saved: 1,022 minutes

Sentiments Projected: 871

Moat Analysis

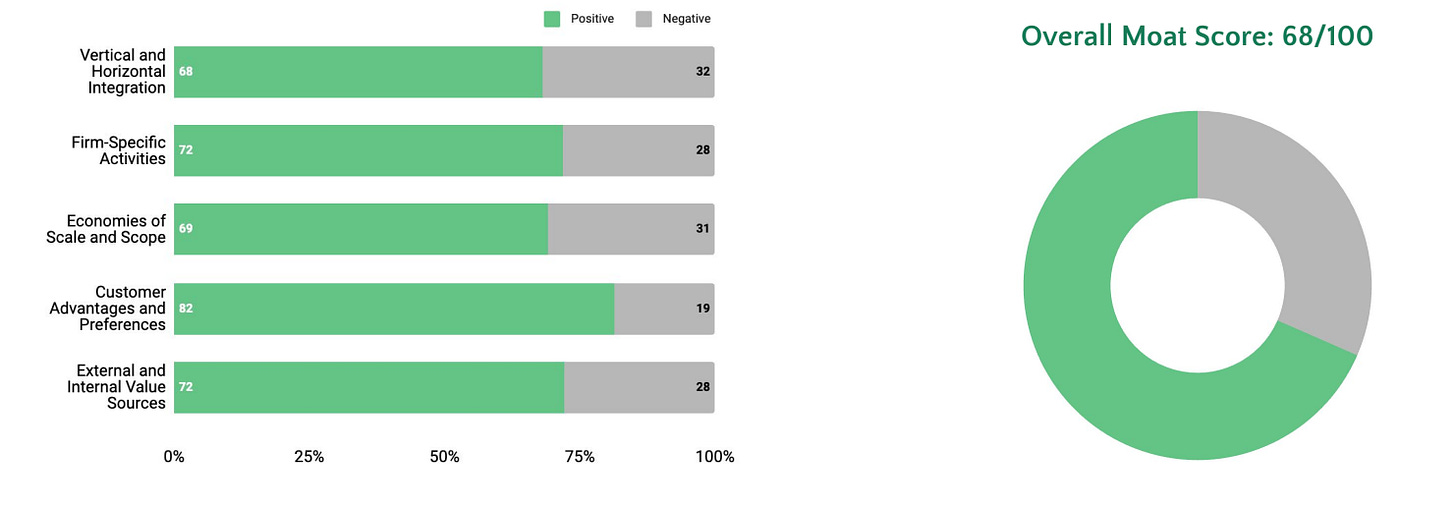

BAT scored a solid 68/100 on their moat analysis. This score reflects the company’s strategic investments in next-generation products and improvements to their existing product lines. BAT benefits from significant economies of scale, strong customer loyalty, and a favourable pricing environment. These factors collectively help the company maintain a competitive edge in the relatively stable tobacco industry

.

Capital Allocation

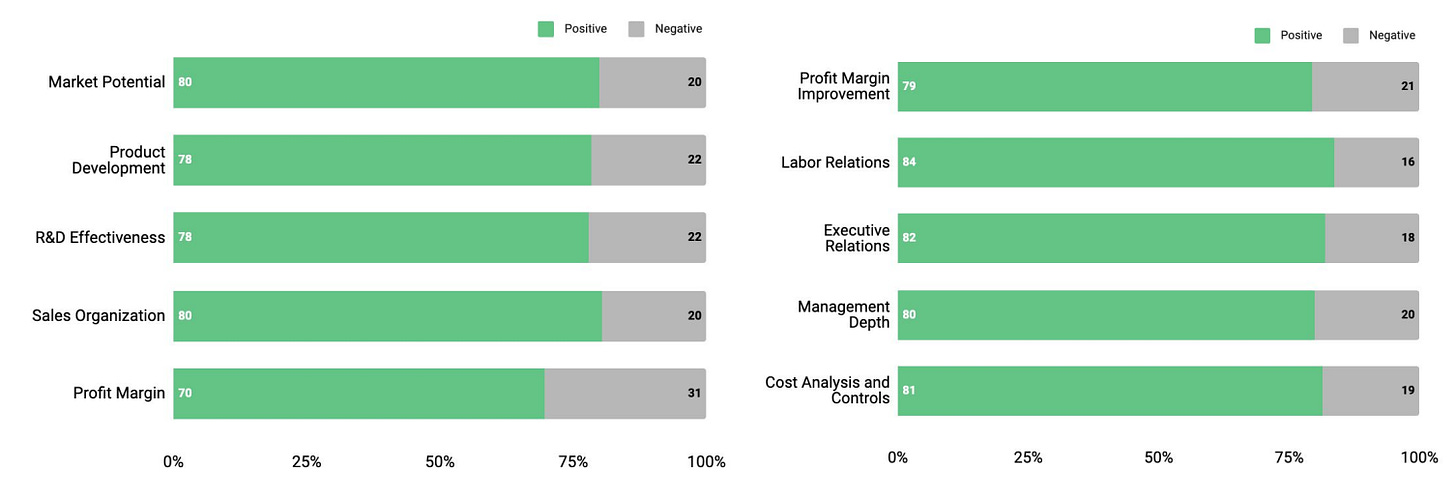

On the capital allocation front, BAT scored 75/100. This score underscores the company’s strategic approach to managing resources, prioritizing shareholder value and long-term growth. BAT’s capital allocation philosophy is clear and efficient, supported by strong cash flow management. The company’s balanced dividend policy, strategic share buybacks, and prudent debt management highlight its commitment to maximizing shareholder value while maintaining financial health.

Business Quality

BAT also did well in terms of business quality, scoring 77/100, reflecting the principles of Philip Fisher. This score is indicative of the company’s robust market potential and operational strength. BAT’s diverse product offerings and strategic focus on emerging markets, especially in new categories like vapour and smokeless products, play a crucial role here. Their effective R&D efforts have led to innovative products that cater to evolving consumer preferences, supporting sustained sales growth.

Leadership and Corporate Culture

Leadership at BAT shows strong integrity, fostering a positive corporate culture and effective internal communication. The depth in management and excellence in cost analysis and controls further enhance operational stability and financial reporting accuracy. BAT’s long-term profit outlook, minimized reliance on equity financing, and commitment to transparent investor communication highlight its strategic foresight and sustainable growth approach.

Conclusion

To sum up, British American Tobacco has shown resilience and strategic foresight in navigating its mature stage in the competitive lifecycle. Despite a challenging year and significant depreciation charges, BAT’s scores of 68/100 on moat analysis, 75/100 on capital allocation, and 77/100 on business quality indicate a solid foundation for future growth.

Stay tuned for more insights and updates on BAT and other market movers as we continue to track and analyse the financial landscape.

Until next time, keep investing wisely!

James

P.S. If you like it, or don’t like it, please let me know what you think. I am open to constructive criticism. I am in the “FAFO” phase, so your comments and suggestions are welcome.

Disclaimer: The information, recommendations, ratings, and opinions in this report are for information purposes only and do not constitute an offer to buy or sell securities. The contents of this report do not amount to “advice” under the Financial Advisory and Intermediary Services Act, 2002. Investors should seek financial advice regarding the appropriateness of investing in any securities discussed in this report.