Anheuser-Busch InBev SA/NV: A Qualitative Analysis (July 2024)

Trying to measure the moat, capital allocation and overall business quality of ABInBev...

Hello, fellow investors!

This time, we’re diving into Anheuser-Busch InBev’s (AB InBev) strategic positioning and performance, scrutinising their moat, capital allocation, and overall business quality based on their 2023 Annual Report.

You can download the research pack below:

• The Short Report (Only 3 slides on the Moat Score, 3 on Capital Allocation, and 3 on Business Quality) (Click Here)

• The extracted text from the annual report (in CSV) (Click Here)

A summary dump on the 45 themes analysed (Click Here)

• The Annual Report that I used for the analysis (Click Here)

Some fun stats:

• Annual Report Pages: 235

• Extracted Words: 12,954

• Reading Time Saved: 576 minutes

• Sentiments Projected: 527

Moat Analysis

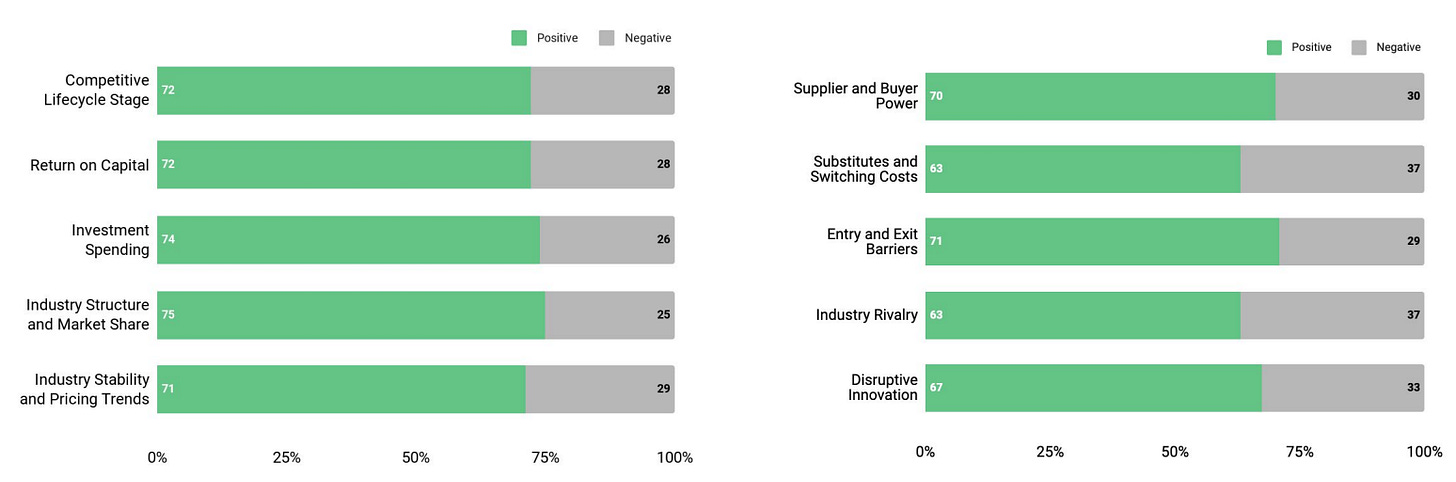

AB InBev scored a solid 74/100 on their moat analysis. The company’s strategic positioning leverages global scale, a diversified footprint, and an unparalleled ecosystem to sustain market leadership and drive growth. Despite challenges such as the negative publicity around Bud Light in 2023, AB InBev’s focus on “premiumization” (their word, not mine), digitisation, and business optimisation has showcased its resilience and agility. Strong financial performance, evidenced by increased EBITDA and revenue, underscores its ability to earn returns above its cost of capital. Significant investments in infrastructure and innovation, such as new breweries and advanced production facilities, further bolster its competitive advantage and support long-term growth.

Capital Allocation

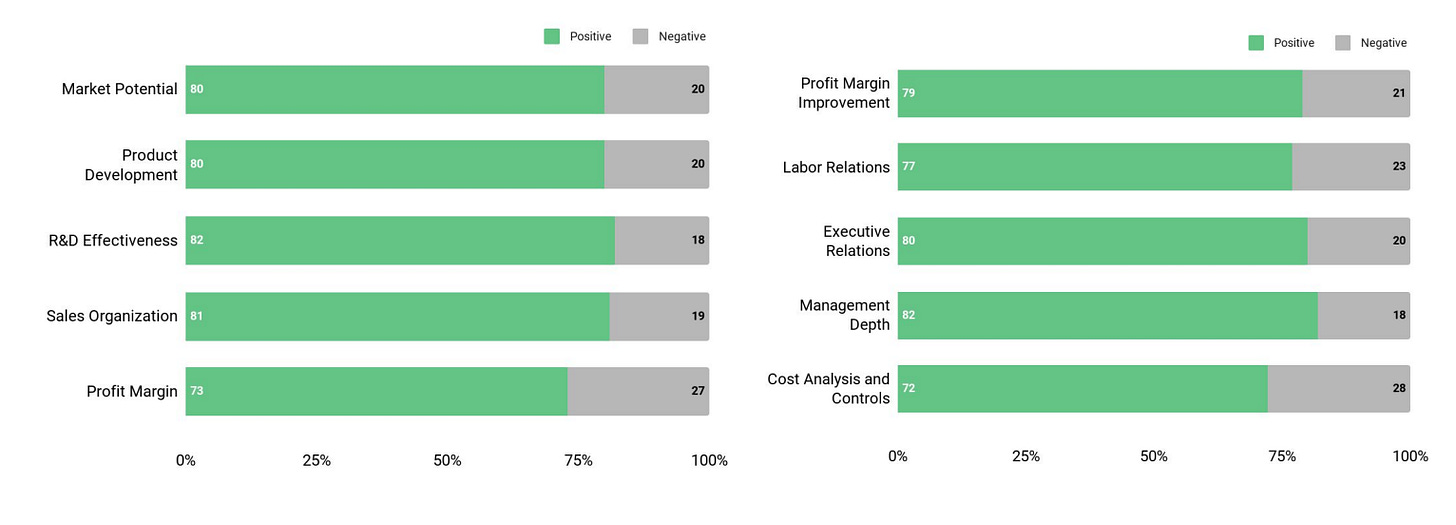

On the capital allocation front, AB InBev scored 74/100. This score underscores the company’s strategic approach to managing resources, prioritising shareholder value and long-term per-share growth. The company’s efficient resource deployment is evident in its strategic capital expenditures and robust balance sheet management, ensuring sufficient liquidity to cover future maturities. AB InBev’s consistent returns on invested capital and strong cash flow management further highlight their financial discipline. Notable increases in operating cash flow and a balanced dividend policy support both shareholder returns and reinvestment opportunities, while strategic share buybacks enhance shareholder value.

Business Quality

AB InBev scored an impressive 80/100 in terms of business quality. This score reflects the company’s robust market potential and operational strength. AB InBev leverages its global scale, strategic partnerships, and innovative approaches to ensure sustainable growth. Its diverse product portfolio, which includes traditional, no-alcohol, and speciality beers, positions it well for long-term success. Significant investments in research and development highlight a dedication to continuous product innovation and process optimisation. Additionally, AB InBev’s strategic initiatives, such as digitizing its ecosystem through platforms like BEES, underline its focus on enhancing consumer experience and expanding market reach.

Conclusion

To sum up, Anheuser-Busch InBev has shown resilience and strategic foresight in navigating its mature stage in the competitive lifecycle. With a moat score of 74/100, capital allocation score of 74/100, and business quality score of 80/100, AB InBev indicates a solid foundation for future growth.

Stay tuned for more insights and updates on AB InBev and other market movers as we continue to track and analyse the financial landscape.

Until next time, keep investing wisely!

James

P.S. If you like it, or don’t like it, please let me know what you think. I am open to constructive criticism. I am in the “FAFO” phase, so your comments and suggestions are welcome.

Disclaimer: The information, recommendations, ratings, and opinions in this report are for information purposes only and do not constitute an offer to buy or sell securities. The contents of this report do not amount to “advice.”